Page 139 -

P. 139

TRUMP UNIVERSITY WEALTH BUILDING 101

Step 4: Value the Business

Now the fun begins. What a seller thinks his business is worth usually has

nothing to do with the value. Valuation is an art, not a science. Forget the

asking price. A sound valuation includes doing the following:

• Review past fi nancials.

• Achieve an adequate return on your investment.

• Determine how the business will transition to a new owner.

• Understand any inherent problems in the business (e.g., too few cus-

tomers generate too much business).

• And finally, estimate realistic growth potential.

There are many valuation methods, but with most small business acquisi-

tions, the multiple method is used to determine the valuation company’s

financials. Use the “Total Owner Benefits,” which assumes everything remains

status quo after you buy: how much the business will generate to pay your sal-

ary, service the debt, and build the business.

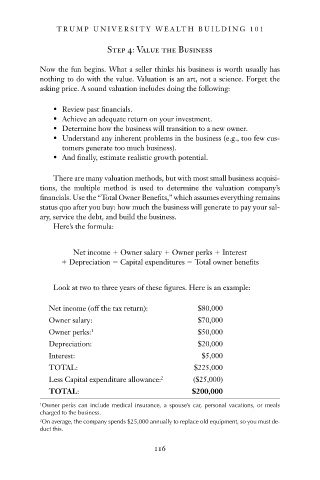

Here’s the formula:

Net income Owner salary Owner perks Interest

Depreciation Capital expenditures Total owner benefi ts

Look at two to three years of these figures. Here is an example:

Net income (off the tax return): $80,000

Owner salary: $70,000

1

Owner perks: $50,000

Depreciation: $20,000

Interest: $5,000

TOTAL: $225,000

2

Less Capital expenditure allowance: ($25,000)

TOTAL : $200,000

1 Owner perks can include medical insurance, a spouse’s car, personal vacations, or meals

charged to the business.

2 On average, the company spends $25,000 annually to replace old equipment, so you must de-

duct this.

116

8/23/07 3:17:29 PM

c12.indd 116 8/23/07 3:17:29 PM

c12.indd 116