Page 305 - Why We Want You To Be Rich - Donald Trump, Robert Kiyosaki.pdf

P. 305

WHYDo You INVEST IN REAL ESTATE? I 299

One reason I recommend people play our games CASHFLOW 101 and

CASHFLOW 202 isso that people will become better investors by training

their brains to see what their eyes cannot. In other words, to see the real

value or lack ofvalue in any investment, regardless ofwhether it is a stock,

bond, mutual fund, business or real estate. I also recommend you play it at

least 10 times because the more you play it, the more your mind will be able

to see - see what most investors miss.

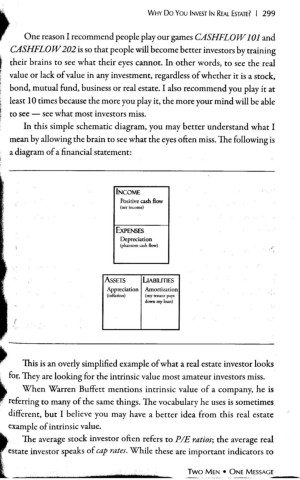

In this simple schematic diagram, you may better understand what I

mean by allowing the brain to see what the eyesoften miss. The following is

a diagram ofa financial statement:

INCOME

Positive cash flow

(net income)

ExPENSES

Depreciation

(phantom cab flow)

AssETS LIABILITIES

Appreciation Amort ization

(intb.rion) (my tenant p<tys

down my loan)

(

This is an overly simplified example ofwhat a real estate investor looks

i for. They are looking for the intrinsic value most amateur investors miss.

~ When Warren Buffett mentions intrinsic value of a company, he is

:' referring to many of the same things. The vocabulary he uses is sometimes

different, but I believe you may have a better idea from this real estate

r. example ofintrinsic value.

The average stock investor often refers to PIE ratios; the average real

restate investor speaks ofcap rates. While these are important indicators to

l Two MEN • ONE MESSAG_E _