Page 179 -

P. 179

TRUMP UNIVERSITY WEALTH BUILDING 101

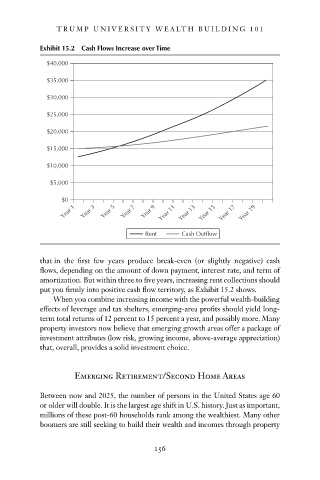

Exhibit 15.2 Cash Flows Increase over Time

$40,000

$35,000

$30,000

$25,000

$20,000

$15,000

$10,000

$5,000

$0

Year 1 Year 3 Year 5 Year 7 Year 9 Year 11 Year 13 Year 15 Year 17 Year 19

Rent Cash Outflow

that in the first few years produce break-even (or slightly negative) cash

fl ows, depending on the amount of down payment, interest rate, and term of

amortization. But within three to five years, increasing rent collections should

put you firmly into positive cash flow territory, as Exhibit 15.2 shows.

When you combine increasing income with the powerful wealth-building

effects of leverage and tax shelters, emerging-area profits should yield long-

term total returns of 12 percent to 15 percent a year, and possibly more. Many

property investors now believe that emerging growth areas offer a package of

investment attributes (low risk, growing income, above-average appreciation)

that, overall, provides a solid investment choice.

Emerging Retirement/Second Home Areas

Between now and 2025, the number of persons in the United States age 60

or older will double. It is the largest age shift in U.S. history. Just as important,

millions of these post-60 households rank among the wealthiest. Many other

boomers are still seeking to build their wealth and incomes through property

156

8/23/07 3:23:03 PM

c15.indd 156

c15.indd 156 8/23/07 3:23:03 PM