Page 226 -

P. 226

Sa ve Money with These Tax Stra tegies

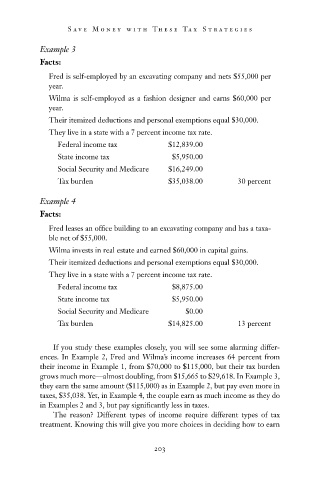

Example 3

Facts:

Fred is self-employed by an excavating company and nets $55,000 per

year.

Wilma is self-employed as a fashion designer and earns $60,000 per

year.

Their itemized deductions and personal exemptions equal $30,000.

They live in a state with a 7 percent income tax rate.

Federal income tax $12,839.00

State income tax $5,950.00

Social Security and Medicare $16,249.00

Tax burden $35,038.00 30 percent

Example 4

Facts:

Fred leases an office building to an excavating company and has a taxa-

ble net of $55,000.

Wilma invests in real estate and earned $60,000 in capital gains.

Their itemized deductions and personal exemptions equal $30,000.

They live in a state with a 7 percent income tax rate.

Federal income tax $8,875.00

State income tax $5,950.00

Social Security and Medicare $0.00

Tax burden $14,825.00 13 percent

If you study these examples closely, you will see some alarming differ-

ences. In Example 2, Fred and Wilma’s income increases 64 percent from

their income in Example 1, from $70,000 to $115,000, but their tax burden

grows much more—almost doubling, from $15,665 to $29,618. In Example 3,

they earn the same amount ($115,000) as in Example 2, but pay even more in

taxes, $35,038. Yet, in Example 4, the couple earn as much income as they do

in Examples 2 and 3, but pay significantly less in taxes.

The reason? Different types of income require different types of tax

treatment. Knowing this will give you more choices in deciding how to earn

203

8/23/07 3:30:21 PM

c18.indd 203

c18.indd 203 8/23/07 3:30:21 PM