Page 225 -

P. 225

TRUMP UNIVERSITY WEALTH BUILDING 101

offenders are Montana (11 percent); Rhode Island (10.098 percent); Vermont

(9.5 percent); California (9.3 percent); and Oregon (9 percent).

Gaining a working knowledge about taxes doesn’t mean you’ll avoid

paying taxes altogether, but avoid paying as much tax as allowed by law. By

understanding the different types of income, and how these types are taxed,

you can hold onto more of your hard-earned dollars. Knowledge equals

power, and in this case, knowledge equals money.

Not all income is created equally and, more importantly, not all income

is taxed equally. To illustrate this point, let’s take a look at the following

fi ctitious example.

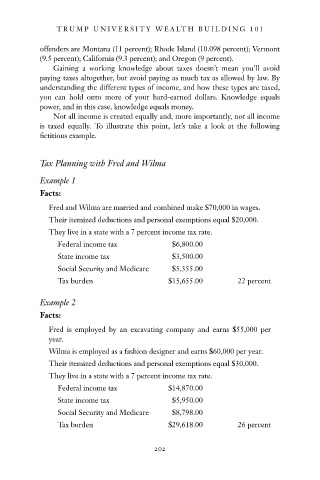

Tax Planning with Fred and Wilma

Example 1

Facts:

Fred and Wilma are married and combined make $70,000 in wages.

Their itemized deductions and personal exemptions equal $20,000.

They live in a state with a 7 percent income tax rate.

Federal income tax $6,800.00

State income tax $3,500.00

Social Security and Medicare $5,355.00

Tax burden $15,655.00 22 percent

Example 2

Facts:

Fred is employed by an excavating company and earns $55,000 per

year.

Wilma is employed as a fashion designer and earns $60,000 per year.

Their itemized deductions and personal exemptions equal $30,000.

They live in a state with a 7 percent income tax rate.

Federal income tax $14,870.00

State income tax $5,950.00

Social Security and Medicare $8,798.00

Tax burden $29,618.00 26 percent

202

8/23/07 3:30:21 PM

c18.indd 202

c18.indd 202 8/23/07 3:30:21 PM