Page 100 - Trump University Commercial Real Estate 101

P. 100

TRUMP UNIVERSITY COMMERCIAL REAL ESTATE 101

purchase price of $ 5.4 million. Assume that you will take out an

interest - only loan at 6 percent, and you and your partners are putting

20 percent down on the deal. (Remember, that doesn ’ t mean you are

putting anything down. That ’ s the beauty of having partners who

are private lenders.)

The seller tells you that gross potential rent is $ 972,000 per year

and you determine the vacancy rate is 8 percent.

You don ’ t care what the theoretical revenue is, because vacancies

exist at the property. Therefore, you want to get to the effective gross

income:

Effective Gross Income Gross Potential Rent Vacancy Cost

First calculate the vacancy cost:

$ 77,760 Vacancy Cost $ 972,000 .08 Vacancy

Now calculate Effective Gross Income, or EGI :

894,240 EGI $ 972,000 Gross Potential Rent

– $77,760 Vacancy Cost

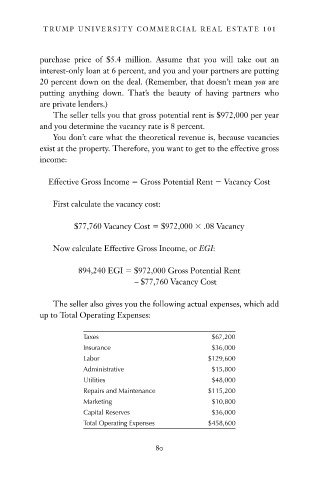

The seller also gives you the following actual expenses, which add

up to Total Operating Expenses:

Taxes $ 67,200

Insurance $ 36,000

Labor $ 129,600

Administrative $ 15,800

Utilities $ 48,000

Repairs and Maintenance $ 115,200

Marketing $ 10,800

Capital Reserves $ 36,000

Total Operating Expenses $ 458,600

80

10/14/08 10:40:41 AM

c04.indd 80 10/14/08 10:40:41 AM

c04.indd 80