Page 102 - Trump University Commercial Real Estate 101

P. 102

TRUMP UNIVERSITY COMMERCIAL REAL ESTATE 101

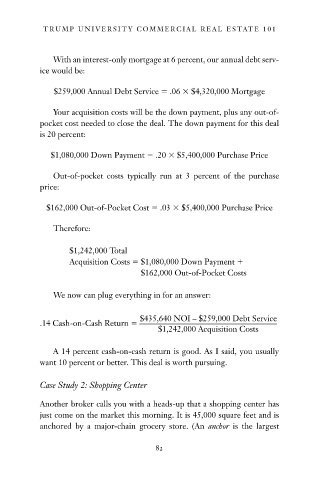

With an interest - only mortgage at 6 percent, our annual debt serv-

ice would be:

$ 259,000 Annual Debt Service .06 $ 4,320,000 Mortgage

Your acquisition costs will be the down payment, plus any out - of -

pocket cost needed to close the deal. The down payment for this deal

is 20 percent:

$ 1,080,000 Down Payment .20 $ 5,400,000 Purchase Price

Out - of - pocket costs typically run at 3 percent of the purchase

price:

$ 162,000 Out - of - Pocket Cost .03 $ 5,400,000 Purchase Price

Therefore:

$ 1,242,000 Total

Acquisition Costs $ 1,080,000 Down Payment

$ 162,000 Out - of - Pocket Costs

We now can plug everything in for an answer:

$ 435,640 NOI – $ 259,000 Debt Service

.14 Cash - on - Cash Return __________________________________

$ 1,242,000 Acquisition Costs

A 14 percent cash - on - cash return is good. As I said, you usually

want 10 percent or better. This deal is worth pursuing.

Case Study 2: Shopping Center

Another broker calls you with a heads - up that a shopping center has

just come on the market this morning. It is 45,000 square feet and is

anchored by a major - chain grocery store. (An anchor is the largest

82

10/14/08 10:40:42 AM

c04.indd 82 10/14/08 10:40:42 AM

c04.indd 82