Page 101 - Trump University Commercial Real Estate 101

P. 101

Ho w to Read a Deal

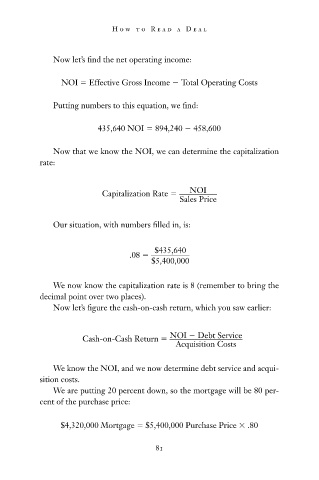

Now let ’ s find the net operating income:

NOI Effective Gross Income Total Operating Costs

Putting numbers to this equation, we fi nd:

435,640 NOI 894,240 458,600

Now that we know the NOI, we can determine the capitaliza tion

rate:

NOI

Capitalization Rate __________

Sales Price

Our situation, with numbers filled in, is:

$ 435,640

.08 __________

$ 5,400,000

We now know the capitalization rate is 8 (remember to bring the

decimal point over two places).

Now let ’ s figure the cash - on - cash return, which you saw earlier:

__________________

Cash - on - Cash Return NOI Debt Service

Acquisition Costs

We know the NOI, and we now determine debt service and acqui-

sition costs.

We are putting 20 percent down, so the mortgage will be 80 per-

cent of the purchase price:

$ 4,320,000 Mortgage $ 5,400,000 Purchase Price .80

81

10/14/08 10:40:41 AM

c04.indd 81 10/14/08 10:40:41 AM

c04.indd 81