Page 194 -

P. 194

Gro w Y our Retirement Nest Egg

while you’re working and help determine the types of investments you should

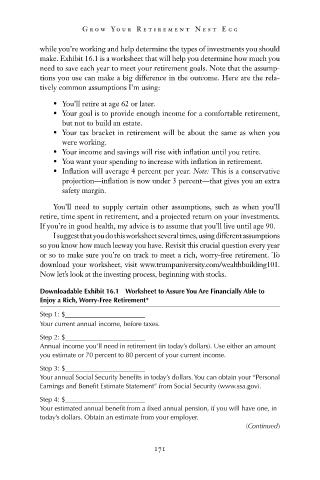

make. Exhibit 16.1 is a worksheet that will help you determine how much you

need to save each year to meet your retirement goals. Note that the assump-

tions you use can make a big difference in the outcome. Here are the rela-

tively common assumptions I’m using:

• You’ll retire at age 62 or later.

• Your goal is to provide enough income for a comfortable retirement,

but not to build an estate.

• Your tax bracket in retirement will be about the same as when you

were working.

• Your income and savings will rise with inflation until you retire.

• You want your spending to increase with inflation in retirement.

• Inflation will average 4 percent per year. Note: This is a conservative

projection—inflation is now under 3 percent—that gives you an extra

safety margin.

You’ll need to supply certain other assumptions, such as when you’ll

retire, time spent in retirement, and a projected return on your investments.

If you’re in good health, my advice is to assume that you’ll live until age 90.

I suggest that you do this worksheet several times, using different assumptions

so you know how much leeway you have. Revisit this crucial question every year

or so to make sure you’re on track to meet a rich, worry-free retirement. To

download your worksheet, visit www.trumpuniversity.com/wealthbuilding101 .

Now let’s look at the investing process, beginning with stocks.

Downloadable Exhibit 16.1 Worksheet to Assure You Are Financially Able to

Enjoy a Rich, Worry-Free Retirement*

Step 1: $

Your current annual income, before taxes.

Step 2: $________________________

Annual income you’ll need in retirement (in today’s dollars). Use either an amount

you estimate or 70 percent to 80 percent of your current income.

Step 3: $________________________

Your annual Social Security benefits in today’s dollars. You can obtain your “Personal

Earnings and Benefi t Estimate Statement” from Social Security (www.ssa.gov).

Step 4: $________________________

Your estimated annual benefi t from a fi xed annual pension, if you will have one, in

today’s dollars. Obtain an estimate from your employer.

(Continued)

171

8/23/07 3:25:20 PM

c16.indd 171

c16.indd 171 8/23/07 3:25:20 PM