Page 247 - Why We Want You To Be Rich - Donald Trump, Robert Kiyosaki.pdf

P. 247

I AM STILL IN SCHOOl, WHAT SHOULD I Do? I 241

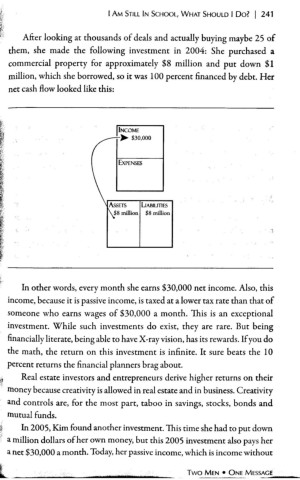

After looking at thousands of deals and actually buying maybe 25 of

them, she made the following investment in 2004: She purchased a

commercial property for approximately $8 million and put down $1

million, which she borrowed, so it was 100 percent financed by debt. Her

net cash flow looked like this:

-: INCOME

~ $30,000

I ExP ENSfS

AssETS L IABU.mFS

\!8 million $8millioll

i

r

In other words, every month she earns $30,000 net income. Also, this

income, because it ispassive income, is taxed at a lower tax rate than that of

someone who earns wages of $30,000 a month. This is an exceptional

investment. While such investments do exist, they are rare. But being

financially literate, being able to have X-ray vision, has its rewards. Ifyou do

the math, the return on this investment is infinite. It sure beats the 10

percent returns the financial planners brag about.

~~ Real estate investors and entrepreneurs derive higher returns on their

money because creativity is allowed in real estate and in business. Creativity

and controls are, for the most part, taboo in savings, stocks, bonds and

mutual funds.

In 2005, Kim found another investment. This time she had to put down

a million dollars ofher own money, but this 2005 investment also pays her

a net $30,000 a month. Today, her passive income, which isincome without

f: _

----

.,: . Two MEN • ONE MESSAGE

~ _----O.~..;:;....;.