Page 90 - Trump University Commercial Real Estate 101

P. 90

TRUMP UNIVERSITY COMMERCIAL REAL ESTATE 101

Comparable Method

This method compares properties that share a similar form and func-

tion. For instance, a class - B apartment complex would be compared to

a similar class - B property. A 15,000 - square - foot retail strip center

would be compared to a property of similar size and age.

With commercial properties, you compare not only sales prices

but also price - per - square - foot. When comparing apartment com-

plexes, you ’ ll often compare price per unit.

One problem with the comparable method is that your market

might not contain other properties that are truly comparable.

Income Method

I said in an earlier chapter that the value of a commercial property is

not so much in the property, but in the cash flow it generates. You

determine the key cash flow number by taking annual income and sub-

tracting expenses. This is the NOI we ’ ve already discussed.

Notice that you do not take into consideration the mortgage amount.

That ’ s not a property characteristic because you might buy for all cash

and I might buy with lots of debt. Either way, it ’ s the same property.

,

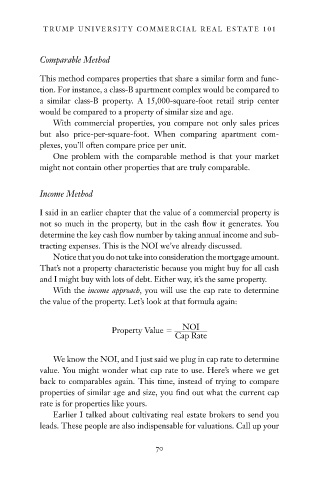

With the income approach you will use the cap rate to determine

the value of the property. Let ’ s look at that formula again:

NOI

Property Value _________

Cap Rate

We know the NOI, and I just said we plug in cap rate to determine

value. You might wonder what cap rate to use. Here ’ s where we get

back to comparables again. This time, instead of trying to compare

properties of similar age and size, you find out what the current cap

rate is for properties like yours.

Earlier I talked about cultivating real estate brokers to send you

leads. These people are also indispensable for valuations. Call up your

70

10/14/08 10:40:38 AM

c04.indd 70 10/14/08 10:40:38 AM

c04.indd 70