Page 87 - Trump University Commercial Real Estate 101

P. 87

Ho w to Read a Deal

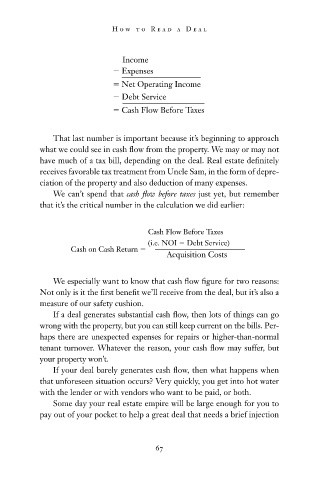

Income

Expenses

Net Operating Income

Debt Service

Cash Flow Before Taxes

That last number is important because it ’ s beginning to approach

what we could see in cash flow from the property. We may or may not

have much of a tax bill, depending on the deal. Real estate defi nitely

receives favorable tax treatment from Uncle Sam, in the form of depre-

ciation of the property and also deduction of many expenses.

We can ’ t spend that cash fl ow before taxes just yet, but remember

that it ’ s the critical number in the calculation we did earlier:

Cash Flow Before Taxes

(i.e. NOI Debt Service)

Cash on Cash Return

Acquisition Costs

We especially want to know that cash fl ow fi gure for two reasons:

Not only is it the fi rst benefi t we ’ ll receive from the deal, but it ’ s also a

measure of our safety cushion.

If a deal generates substantial cash flow, then lots of things can go

wrong with the property, but you can still keep current on the bills. Per-

haps there are unexpected expenses for repairs or higher - than - normal

tenant turnover. Whatever the reason, your cash flow may suffer, but

your property won ’ t.

If your deal barely generates cash flow, then what happens when

that unforeseen situation occurs? Very quickly, you get into hot water

with the lender or with vendors who want to be paid, or both.

Some day your real estate empire will be large enough for you to

pay out of your pocket to help a great deal that needs a brief injection

67

10/14/08 10:40:37 AM

c04.indd 67 10/14/08 10:40:37 AM

c04.indd 67