Page 86 - Trump University Commercial Real Estate 101

P. 86

TRUMP UNIVERSITY COMMERCIAL REAL ESTATE 101

you should take the deal to the next stage, and you must analyze

quickly: Good deals do not stay on the market long.

Another Key Measure: Debt Coverage Ratio

Many investors buy based on speculation. They get into a deal that

produces very little cash flow and hope to make all their dough from

appreciation.

Yes, such deals can work out. It ’ s even sometimes worth getting

into a deal with negative cash flow, where the property doesn ’ t throw

off cash, but requires cash. Nevertheless, don ’ t bother with these types

of deals when you ’ re starting out. There are simply too many proper-

ties that generate positive cash flow for you to get involved with a nail -

biter of a deal early on.

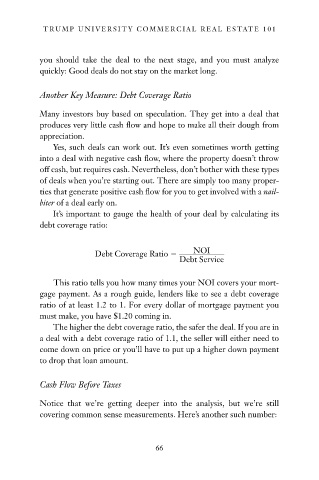

It ’ s important to gauge the health of your deal by calculating its

debt coverage ratio:

NOI

Debt Coverage Ratio ____________

Debt Service

This ratio tells you how many times your NOI covers your mort-

gage payment. As a rough guide, lenders like to see a debt coverage

ratio of at least 1.2 to 1. For every dollar of mortgage payment you

must make, you have $ 1.20 coming in.

The higher the debt coverage ratio, the safer the deal. If you are in

a deal with a debt coverage ratio of 1.1, the seller will either need to

come down on price or you ’ ll have to put up a higher down payment

to drop that loan amount.

Cash Flow Before Taxes

Notice that we ’ re getting deeper into the analysis, but we ’ re still

covering common sense measurements. Here ’ s another such number:

66

10/14/08 10:40:36 AM

c04.indd 66

c04.indd 66 10/14/08 10:40:36 AM